The biggest risk for leaks in your sales and marketing funnel is no different than leaks in your plumbing – the weakness lies in where pipelines connect and transition.

For b2b SaaS companies, that connection point is 1) marketing leads to SDRs and 2) SDR to AE.

The solution? Process and measurement. Leaks are inevitable, but they are easy to fix when you have a system to watch – before a drip becomes a flood.

The Backstory

The sales teams for b2b SaaS companies are an evolving beast. In a previous role, I ran marketing for a Field Service Software startup. As we grew from a $20 million to $120 million valuation, our sales team went through this evolution:

- 4 AEs and 0 SDRs

- 4 AEs and 2 SDRs

- 5 AEs, 4 Outbound SDRs, 2 Inbound SDRs

- 6 AEs, 8 Outbound SDRs, 3 Inbound SDRs

After lots of testing, we FINALLY moved to a structure that’s extremely common today – using both Inbound and Outbound SDRs

A quick aside here. I’m using the term SDR aka Sales Development Rep. You might call them Business Development Reps (BDRs). Whatever you call them, it’s the person in your org that bridges the gap between MQL and SQL.

What’s the difference between inbound and outbound SDRs

Outbound SDRs

- The main objective for an Outbound SDRs is to uncover just enough pain to get the prospect on a follow-up call with an Account Executive.

- Outbound SDRs are hunters. They’re dialing for dollars.

- Depending on the quality of the prospect list, an outbound SDR is making between 60-120 calls per day.

- The 3 most important traits? Persistence. Persistence. Persistence.

Inbound SDRs

- The main objective of an Inbound SDR is to nurture and guide prospects.

- Inbound SDRs are farmers. They take an already viable, self-selected, prospect and help turn them into an opportunity for an Account Executive.

- Think of Inbound SDRs as educators. A solid inbound SDR is a blend of customer support and outbound sales.

- Each prospect that comes their way recognizes their pain and is seeking information. Inbound prospects want info and not to feel like they’re being sold to. Ideally, your inbound prospect begins to evaluate different solutions and is digging into the details of each option.

Why you should have separate inbound and outbound SDR teams?

You might be thinking “maybe I can have my SDRs handle both inbound and outbound'”. Eh, bad idea…for a variety of reasons.

Messy Incentive Structure

It’s very difficult to create an incentive structure that motivates an SDR to work both inbound and outbound leads with equal effort.

Put yourself in the SDRs shoes. On the outbound side, you’re playing the call volume game where 1% to 2% of the leads may turn into an SQL.

On the other hand, inbound leads will schedule a demo at 30%+. Where would you focus your efforts?

It would be foolish to pay your SDR equally for inbound and outbound leads. So the solution becomes a compensation model with lots of rules.

Compensation models with lots of rules are harder to understand. And when an SDR doesn’t fully understand their compensation model, it becomes much harder for your SDR to prioritize their efforts.

Measuring Success

Beyond the incentive structure, mixing inbound and outbound leads makes it difficult to measure success and establish benchmarks. How do you compare the performance of two SDRs when one of them gets a couple of extra leads that have a 3000% higher chance of turning into a demo?

If you say, “well I’m just going to distribute them equally”. So, you are going to take those highly valuable inbound leads and hand them to both your top-performing SDR and the kid you just hired? I hope not.

Once you’ve decided to break your inbound and outbound teams apart, you now have to decide who will manage them.

Who should manage inbound SDRs

Inbound SDRs should roll up under the marketing function. Sure, I might be a little bit biased. However, experience has taught me that this structure makes the most sense for two key reasons.

Goal Alignment

Marketing’s success is directly impacted by the inbound SDR team’s ability to convert leads to SQLs. This goes back to the idea of “one throat to choke”. If Inbound isn’t working, it’s all on marketing.

Chain of Custody

The stage-gate between marketing and sales is typically between the MQL and SQL stages. This handoff point is a clear breakpoint between marketing and sales. The metrics used to measure marketing and sales performance become much cleaner if we use SQL as the handoff instead of something like MQL. Speaking of metrics…

The metrics you should use to measure SDR performance

Hopefully, at this point, I’ve convinced you that your Inbound SDRs are under the marketing umbrella. Now, how to align their goals to roll up to the marketing team’s goals.

As one of my mentors used to say, ‘people only study what’s going to be on the test’. When I look at the success of an Inbound SDR program and marketing as a whole, I have a single bellwether metric in mind SQLs.

SQL can mean a lot of different things to different companies. For the sake of this discussion – a lead becomes an SQL when the SDR books a demo for the AE.

Note: No matter how you define it, make sure your stages are clearly defined across your organization. When you say ‘SQL’, everyone in the sales and marketing function should be on the same page for what that definition is.

Here are the three metrics for monitoring your Inbound SDR programs contribution to SQLs:

- New inbound lead response time

- Leads to Demos booked

- Booked to GOOD SIT

Metric #1: New Inbound Lead Response Time

New inbound lead response time = ‘SDR reaches out to prospect timestamp’ – ‘Prospect fills out a form timestamp’

Someone fills out a form. An email notification goes out to the sales team. And then…crickets. That’s the industry standard. In fact, the average response for a digital lead is 17 hours. I’m going to type that again…17 hours! That’s criminal.

So, why are your SDRs so slow to respond?

- It’s not something they’re measured on or incentivized to focus on

- They don’t have their CRM and marketing platforms set up to track it

- They don’t view lead response time as a critical metric

- SDRs have priorities split across many activities and there is no incentive.

Five minutes. That’s the benchmark for success. If you are currently averaging a 30 min response time and improve it to 5 min, you’ll average about 141% more conversions.

Why a 5-minute response time?

- “First Impression” moment. From the eyes of the prospect, filling out a form and getting a response almost immediately shows me what my future interactions with you will look like.

- The prospect is thinking about the problem. Take a moment to consider the last time you filled out a form online – in particular filling out a form to request a meeting with someone. That’s a big barrier and shows huge motivation for buyer-ready intent. You want to be on the phone with them

- They are available right now. This is two-fold. 1) The prospect is most likely not in a meeting or working on something else because they just filled out a form. 2) You might just get lucky and interrupt the prospect as they are researching other companies.

- Out hustle the competition. Do you think you’re the only company that just got a form fill? Imagine you are the first of five forms they filled out. Now imagine you are the 3-4 company to respond. Not a good look.

If that doesn’t convince you I’m not sure what will. But seriously, 5 minutes.

How to implement a 5-minute response time?

In one company I worked with, they had between 4 and 12 inbound form fill leads coming in each day.

At the time, there was an Inbound SDR team of two handling all inbound leads. The process I set up for handling those inbound leads:

- Prospect fills out a form on the website

- Information is passed from the form to Salesforce via a web-to-lead form

- A new lead is created in Salesforce with a timestamp and a status of MQL

- A notification goes out to both SDRs

- The SDR changes the status of the lead in SFDC from “MQL” to “working” while calling the prospect

With the above process, we had everything we needed to measure whether or not each lead hit the 5-minute threshold.

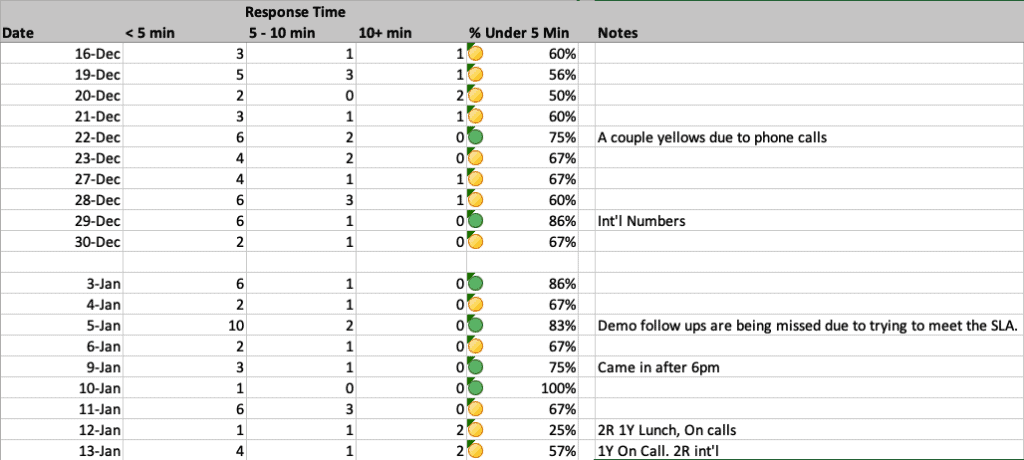

Part of the SDRs compensation was tied to hitting a five-minute response rate for 80% of inbound leads. And every morning I’d take 10 minutes and tally up the spreadsheet (see below) and go through each lead with the SDRs.

The reason for going through this process manually was to identify low effort/high impact fixes early on in the process. With this approach, I was able to quickly solve small “process” issues to get to our true number.

Metric #2: Leads to Demos Booked

‘Leads to Demos Booked’ equals ‘Inbound Demos Booked’ / ‘Total Inbound Leads’

There’s an important distinction here. It’s demos booked…not necessarily the number of demos that sit. Monitoring ‘Leads to Demos Booked’ allows you to test the following:

- Quality of new leads / new lead channels

- Individual SDR performance vs. historical SDR performance

- New SDR follow-up cadences

Number three is a big one. You should be constantly testing your SDRs call/email cadences – both in number of touches and frequency of touches. The tests you run will be reflected in your Leads to Demo Booked metric.

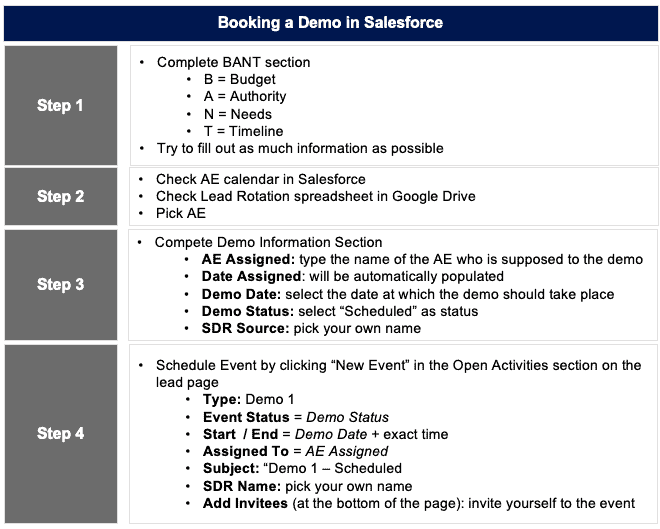

Let’s look at how you would implement this in SFDC.

How to Implement: Option #1 Using SFDC Events to Track Demos

Using events is my preferred method. It allows for tracking the various scenarios that can play out when a demo is booked. A prospect might no-show, they might reschedule, or they might just show up when they said they would (woohoo!). Each of these statuses can be updated and tracked on the event. The reason for tracking this is to get benchmarks on SDRs.

How to Implement: Option #2 Using SFDC Lead Status to Track Demos

If you’re not using events, you could create a new lead status. Create a new status like “Demo Booked”. This is easier to implement but gives you less visibility into reschedules and no-shows.

Whichever choice you make, the most important piece is documenting the process. It will be impossible to measure effectively if there isn’t a clear process for SDRs to follow when booking demos. Here’s an example process:

Ok, on to Metric #3.

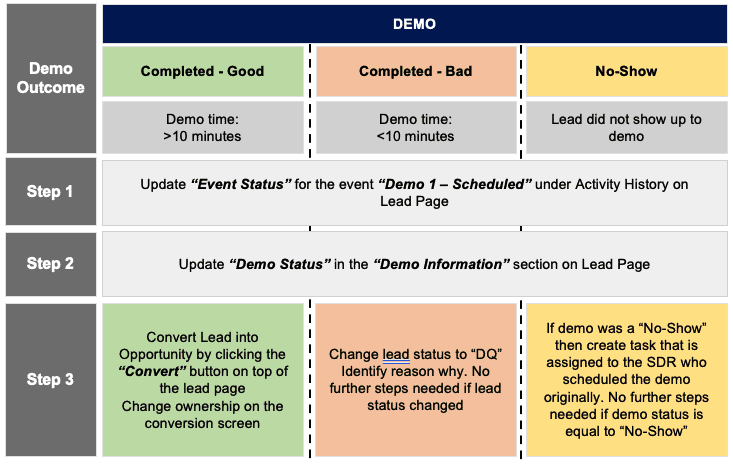

Metric #3: Demos Booked to Good Sit

‘Demos Booked to Good Sit’ is the hustle metric. This metric highlights why SDRs own the lead until the prospect actually shows up for the demo. If the prospect ‘no shows’ or ‘reschedules’, it’s on the SDR to get that demo rebooked.

Let’s start with what a “Good Sit” is. A Good Sit might have the following criteria.

- Prospect shows up for the demo (duh)

- Prospect meets the ‘sales qualified’ criteria. This will mean different things for different companies. Typically, its characteristics like – right industry, right person, actively shopping, etc. Again, this needs to be a documented agreement between marketing and sales

- Demo lasts more than 10 minutes (or whatever minimum you want to set)

Note: Demos Booked to Good Sit is a great metric for outbound reps too. You’re way more likely to have a prospect ghost you on demos scheduled via a cold outbound call.

I’ve seen SDRs that get lots of demos booked but have a terrible sit rate. Simply put, some prospects are non-confrontational and, if pressured enough, will agree to a demo with no intention of showing up.

When this happens your AEs will get pissed. Their calendar space is limited. If it’s filled with no-shows, you’re messing with their bankroll… don’t mess with an AEs bankroll.

How to Implement: Option #1 Using SFDC Events to Track ‘Demo Booked’ Outcome

If you’re using events (again, my preferred method), you should add a custom field to the event with a picklist. The picklist options: Demo Booked, Good Sit, Bad Sit, No Show, Reschedule.

Each time a demo is booked, a new event is created. So, if a prospect reschedules, a second event will be created and when reporting is run you’ll be able to see that two demos were booked and the outcome of each one.

The reason I prefer Events is it allows you to better report on no-shows and reschedules – both of which are a big drain on your AE resources. Events allow you to monitor how often these outcomes happen.

How to Implement: Option #2 Using SFDC Lead Record to Track ‘Demo Booked’ Outcome

Just like tracking using an Event, tracking demo outcomes with a lead record requires creating a custom field with a picklist. However, using a lead record makes it harder to track how often no-shows and reschedule happen. Here’s an example why.

Example

- A prospect no-shows for a demo

- The SDR changes the field ‘Demo Outcome’ to ‘no-show’ and follows up with the prospect

- The prospect reschedules and the SDR changes ‘Demo Outcome’ to ‘demo booked’

Because the SDR is changing the same field reporting on that field becomes quite a bit trickier.

Improving Your Demos Booked to Good Sit Rate

The great part about tying these metrics to compensation or performance bonuses is that your SDRs will naturally figure out ways to get better results. Here are a few that I highly recommend

- Booking the demo isn’t enough. You need scheduled reminders for the prospect. I like to have an email reminder automatically go out 24 hours in advance and 1 hour in advance.

- Push prospects to book a demo no more than 7 days out.

- Maintain good calendar visibility. Prospects filling out a form might be ready to demo right now. These are almost always ‘Good Sits’ if an AE has the availability to take the demo on the fly.

Managing the Relationship Between SDRs and AEs

It’s all about feedback. SDRs are usually AEs in training. For that reason, creating a structured feedback loop is invaluable to improving the quality of the leads AEs receive from SDRs and mentoring SDRs as they grow into the AE role.

Most SDRs will be VERY eager to know how the demo they booked went with the AE – in particular if the SDR is compensated for on Good Sits – not Demos Booked.

With that in mind, it’s a good idea to have AEs take 5-10 min after every demo to connect with the SDR and discuss why it was/was not a good demo. These quick feedback sessions provide tips that SDRs can immediately put into action. It also means AEs become a great resource for helping sales leadership identify which SDRs are ready to be promoted.

A Final Word

If there’s one thing you walk away with, it should be the importance of committing to a process. Moreso than each of the metrics discussed above, having organizational buy-in and measurement in place makes for clean, actionable data.

By setting clear expectations and creating a system that allows you to measure the SDR performance, you will position yourself to identify and stop leaks before they wreak havoc on your funnel.